Private Limited Company Definition Business Studies

It is a popular type of business running across the globe under different territory based rules and regulations. The driving factors of this business type are different characteristics, including its legal entity in the state, people trust, and many others. It is also a form of business like other businesses, including public limited companies, partnerships, and sole proprietorships.

A Joint Stock Company is a type of business that gives business ownership rights to shareholders by giving them a certificate of their shares. These shares can be bought or sold anytime from the people who already purchased them. There is the unlimited liability of shareholders in the United States and Limited in Asian countries.

There are different types of joint-stock companies depending upon their goal, their design, their business model, their mission, vision, roles, and stakeholders. Each has its own advantages and disadvantage because of many factors involved in different phases of the business cycle.

In Simpler words, a voluntary association made by different persons under state law for a specific reason is known as a Joint Stock Company. It is started by the collection of initial investment by each member. This capital amount is divided into transferable shares with the liability of shares to their face value.

"A company is an artificial person created by law with a perpetual succession and a common seal."

LORD JUSTICE LINDLEY

Companies are formed with legal ordinances under country law. There can be a minimum of 2 and maximum 50 numbers of shareholders in a Private limited company and a minimum of 7 to no maximum number of shareholders in a Public Limited Company.

Board of directors are managers to operate its function under law of the country – Different Nature of Company is the most popular business form for production and business on large scale. It has its own advantages & disadvantages.

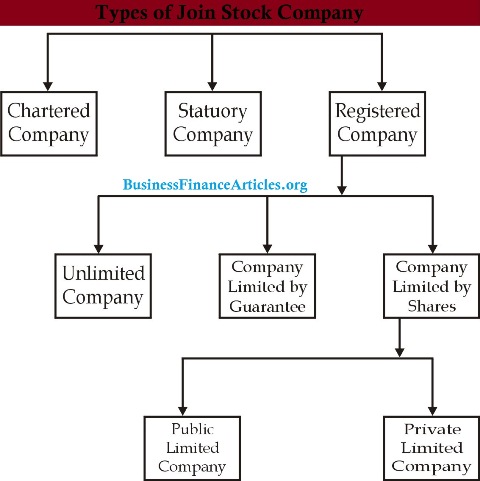

Types of Joint Stock Company

1. Chartered Company

The company which is incorporated by the royal order is called a chartered company. Its power, rights, and functions are governed by the charter, issued at the time of formation. But this kind is not killed and formed in present days. Now all companies are registered under the company ordinance.

Examples

Chartered Mercantile Bank of India, Amsterdam Stock exchange, Chartered Bank of England, Muscovy Company.

2. Statutory Company

This company is formed by the order of the Governor-General President or Prime Minister or by the special act of the legislature. It is organized to carry on some business of national importance. The word "Limited" may not be used after the name of such a company. Each can exercise its particular power which is governed by the terms of its special Act.

3. Registered Company

It is incorporated under the company act. In our country, there is ordinance 1984 to form and supervise the registered company. It possesses a separate legal entity apart from its members.

Example

The registered company may be divide into the following groups

- Unlimited company.

- Company limited by guarantee

- Company limited by Shares

3.1 Unlimited Company

The shareholders of the unlimited company are liable to pay the debts and other obligations of the business as in an ordinary partnership.

Features of Unlimited Joint Stock Company

- It is managed by the board of directions.

- It has a separate legal entity.

- There may be a large number of shareholders and

- Its shares may be transferred to another person.

But despite the foregoing characteristics, the public does not like to form this type of company.

3.2 Company Limited by Guarantee

Where each member gives a guarantee to contribute a specified amount to the company on its winding up, such a company is said to be limited by guarantee. It may or may not also have share capital. If such a company has a share capital, the amount must be mentioned in the charter of the company.

It is not formed to earn profit but the object of the company is to promote social, cultural, and scientific activities such as clubs, chambers of commerce, welfare, and educational association.

3.4 Company Limited by Shares

Where the liability of each member is limited to the nominal amount of the shares which he holds is called company limited by shares. If he pays the value of the shares, his liability will be nil. It is popular among different types of joint stock companies. It may be classified into two groups

What is difference between Public & Private Company?

| PUBLIC | PRIVATE |

| There is no restriction for the maximum number of members but the minimum number must be seven. | There must be at least two members, but not more than fifty. |

| It can invite the public for the subscription of its shares and debentures. | It cannot invite the public for a subscription of any type of securities. |

| Its shares can be transferred and disposed of to other persons without any restriction. | Its members cannot transfer their shares to other persons. |

| Under section 174 a minimum number of directors is seven and the maximum number of directors can be appointed according to the provisions of its Articles of Association. | Its shareholders may elect at least two directors and the maximum number of directors will be described by the Articles of Association. |

| There is compulsion by law to file the prospectus or statement in lieu of the prospectus with the local registrar's office. | As it cannot issue the prospectus there is no restriction to submit the prospectus to the registrar's office. |

| It cannot obtain the certificate of commencement of business without fulfillment of the condition of minimum subscription. | There are no restrictive provisions made in the company ordinance to fulfill the requirements of minimum subscription before its incorporation. |

| It has to hold a statutory meeting and it has to submit the statutory report to the registrar within the prescribed time. | As it does not need to hold a statutory meeting there is no compulsion to submit the statutory report to the registrar's office. |

| Every Public Company has to use the world Limited or "LTD" after its name. | A private company has to mention the "Private" Limited as the last word under section [16 (a) (i)] |

| A public company cannot start its business after obtaining a certificate of incorporation. | It can commence its business soon after receiving this certificate. |

| There is a compulsion to submit the various reports, profit and loss account, Balance Sheet, and minutes to the registrar's office. | There are no restrictions for the submission of some reports to the registrar's office. |

| Some reports and statements must be published for public inspection. | There is no restriction for the publication of various statements for public inspection. |

| It must have to obtain this certificate for the commencement of business. | There is no provision by law to receive this certificate for the commencement of business. |

| Its working field is vast. It can attract a huge amount of capital. So it is possible to conduct heavy and large scale business. | Its capital and financial resources remain limited due to certain restrictions and hindrances so the large-scale business cannot be arranged under this organization. |

Public Company

To a company that is formed by at least seven members and there is no restriction i.e.

- for transferring of shares

- for maximum numbers

- for subscription of shares and debentures is called the public company.

Under section 2 (30), "Public Company" means a company that is not a private company,

Private Company

The company is formed by at least two members and there are restrictions i.e. {Section 2 (28)}

- for a maximum number of members (not more than fifty)

- for transferring of shares

for the subscription of shares and debentures is known as a private company.

How to Convert Private Limited Company into Public Limited Company?

There are several restrictions on Private companies which may result in limited financial resources, limited production activities, limited technical and administrative abilities. Due to these factors, a business may not be expanded and the private company faces high cost per unit, limited sales, and low profit. These hindrances constrain to decide in the conversion of a private company into a public company.

To convert into a public company, it is necessary to alter the articles of association by a special resolution. The following alteration has to be brought in the provision of Articles of Association.

- Shareholders may transfer their shares.

- They may invite the public for subscription of shares and debentures.

- A maximum number of shares i.e. fifty will be struck off from the Articles.

New Articles of Association will be submitted to the registrar's office within two weeks of such alteration. The following necessary documents must be filed with the registrar's office along with altered Articles of Association.

- A list of persons containing their names addresses and other particulars who have agreed to act as directors.

- The written consent of the directors.

- Declaration of the directors to take up their qualification shares

- Declaration 'of the directors that they have paid for their qualification shares, or statement of the fact that they have already taken up and paid for their qualification shares.

- A prospectus or statement in lieu of prospectus.

- A declaration from the directors or secretary or advocate that all the provisions of the Company ordinance have been fulfilled.

After submission of the foregoing documents to the registrar's office Private Company may be converted into a Public Company.

Formation of the Company

The first stage in the formation of a company is that a few persons known as PROMOTERS get together to bring it into existence, to carry on a joint-stock business. They prepare certain necessary legal documents and take all steps necessary for the registration of the company. They convince responsible persons to act as first directors of the company.

There must be a minimum of seven promoters in public companies and two promoters in the private companies under the said ordinance. They have to prepare the following few documents which are to be filed with the Registrar of joint-stock companies of the province where the registered office of the company is to be situated; (Section 30)

- Memorandum of Association

- Articles of Association: When a company adopts Table 'A' in its entirety, it need not file any special articles, but this fact must be endorsed on the Memorandum of Association. These documents require a prescribed stamp and signed by at least seven persons in case of a public company and at least by two in case of a private company

- A statement showing the authorized or registered capital of the company

- A list of persons who have agreed to act as first directors of the company

- Their written consent to act as a director.

- Notice of the situation of the registered office of the company (Section 142)

- A written declaration by the directors to take up and pay for their qualification shares.

- A statutory declaration that the requirements of the law for registration have been duly complied with

Difference Between Memorandum of Association and Articles of Association

Memorandum of Association

• It is a fundamental charter of the company which defines its objects and power.

• It is the nature of the contract between the company and the outside world i.e. debenture holders, bankers and creditors etc.

• It is the most important document of the company so it is called a primary document.

• It contains the aims, objects and conditions upon which the company is granted incorporation.

• It is compulsory for every company to have its Memorandum of Association. So it must be filed with the registrar's office for its registration before the incorporation of the company.

• It is regarded as an unalterable document. However, it may be amended by special resolution and with the sanction of the court or central government.

• If there is any disagreement between Memorandum and Company Ordinance the provisions in the ordinance, will hold good.

• It defines the limit beyond which the company cannot operate. This limit must include the provision of the company ordinance.

Articles of Association

• It contains the rules and regulations for the internal management and administration of the company.

• It does not create any type of contract but it establishes a relation between the company and the inside persons.

• Its importance is considered next to the memorandum so it is known as a secondary document of the company.

• It sets forth the provision by which the powers and aims described in the Memorandum are carried into effect.

• It may or may not be submitted to the registrar for its registration. A company limited by shares may be incorporated without the Articles of Association of their own. So Table "A" of the companies ordinance will be considered its "Articles."

• Priority is not given by the Company ordinance to the Articles over Memorandum Association. In case of conflict with Memorandum, the provisions of Memorandum will be considered as valid.

• It is the subsidiary to the memorandum and it cannot contain any provision contrary to the clauses of the memorandum.

Payment of the Requisite amount

The following payment would have also to be made to the Registrar:

- Requisite amount of duty on share capital.

- Prescribed amount of filing fees. These amount can be deposited into a government treasury.

Certificate of Incorporation

It the Registrar is satisfied that all legal formalities under the companies ordinance have been complied with, he will issue a certificate of incorporation (Section 33). It means that (a) company has been registered and the .liability of its member is limited (b) It has come into existence as a legal entity apart from its members.

A private company may start its business at once after obtaining this certificate. But the public company cannot commence its business without taking the following further steps.

Issue of Prospectus

The promoters have to issue a prospectus to invite the public to subscribe to its shares and debentures. A Private Company is not entitled to advertise this document. No prospectus may be issued unless a copy has been filed with the registrar. It must be signed by every person named in it as a director or his agent authorized in writing.

Allotment of Shares

When applications have been received from different persons, the directors will allot the shares to applicants. As the allotment is the acceptance of the offer of the applicant, and as such, constitutes a binding contract with the applicants.

Certificate of Commencement of Business

A public company may not commence its business unless the following documents are submitted to the registrar:-

Minimum Subscription

A statutory declaration on the prescribed form that the shares have been allotted to an amount not less in the whole than the minimum subscription.

Payment of Shares

Every director of the company has paid for the Company's qualification shares.

Submission of Prospectus

The company has filed a prospectus or statement in lieu of a prospectus with the registrar.

Declaration Regarding condition

A statutory declaration by the secretary or one of the directors on the prescribed form that all. the conditions have complied with companies ordinance 1984.

After verifying these foregoing documents, the Registrar issues a certificate of commencement of business to the Public Company. Now this company is entitled to commence its business from the date of obtaining this certificate.

Why Joint Stock Company is Good? The most Amazing Advantages

Features & Advantages

Features

• Liability

• Capital

• Management

• Life

• Objective

• Opportunities

• Confidence

• Risk

• Entity

• Transfer

• Promotion

• Business Expansion

• Loss Risk

• Does Funds increase

• Jobs

• Flexible

• Economies

• Economic Activities

• Bank Loans

• Roles

• Agreement

• Can change business nature

• Members

Advantages

• Limited

• Huge

• Expert

• Longest

• Earn Profit

• More

• More

• Less

• Legal

• Yes

• Yes

• Yes

• Less

• Yes

• More

• Yes

• Large Scale

• Increased

• Yes at Company Name

• Numerous

• Can enter with own name

• Yes

• Minimum 7 in Public Limited to no Maximum and 2-50 in Private Limited

Limited Liability

The liability of each shareholder is limited to the unpaid value of the share holds. If he has already paid the total value of the shares, his liability will be nil. Private assets of the members are not liable to settle the business obligations. But in sole tradership and partnership, the private property of owners is also to pay the debts of the business.

Larger Capital

As there is no restriction for the maximum numbers in the public company, it can attract huge capital from thousand of persons of varying incomes. Thus the problems of deficiency of capital may not arise in this organizational structure.

Expert Management

Joint stock companies hire professional directors in many ways as well as the service of qualified technical and administrative abilities due to its sound financial sources. The management is generally conducted by expert and professional directors.

So, its sources can be utilized to the maximum for productive purposes. They overcome the depression phase of the business cycle with their experience to retain in the market.

Long Life (Perpetual Succession)

It normally possesses a perpetual life. The death of a director or member cannot affect the life of the joint stock company. it has a separate life apart from its members. On the other side, the biggest disadvantage of a partnership is that the death of any partner may dissolve the partnership.

Objective of Formation

The basic object of the formation of the joint-stock company is to earn profit. While profit is not distributed among the shareholders but some portion of the profit is transferred to the reserve fund. So that it may be used at the time of emergency.

Opportunity for Investment

As the company can divide its ownership into shares of a small denomination, it is possible. All groups of society to invest their amount in joint stock company.

Public Confidence

Joint stock company is created by law and is supervised by legal authority. So this form of business can easily win the public confidence and faith. This is no added advantage of a company that the public feels no chances of fraud or misrepresentation.

The major difference in partnership and company is Public has less confidence in one-man ownership and partnership.

Growth of Heavy and Risky Industry

The heavy and risky industry may be started only under this organization due to the following factors.

- Limited liability.

- Larger capital.

- Better management and technical abilities.

Separate Legal Existence

It is created by law or by the particular Act of the company. it possesses separate legal existence apart from its members. So it can accept loans, hold property, make contracts,s and open bank accounts in its own name.

Transferability of Shares

The share of a public company may easily be transferred to another person and may be disposed of in the stock exchange market. So its members are ways in a position to withdraw their capital under its Acts.

Promotion of Thrift

Joint stock company provides the opportunities to the general public for the investment of their savings. So this tendency promotes the habits of savings and thrift among the public.

Expansion of Business

As it can attract a huge amount of capital from the issue of shares, debentures, and bonds, it is possible to increase its business activities for productive purposes. There is no limit to the maximum number of shareholders in the case of a public company, capital may be increased and large business may be commenced. But it is not possible in another form of the organization due to lack of capital.

Minimum Risk of Loss

There is a minimum chance of loss under this organization. If there is a loss it will be sustained by a large number of investors. So the hardship cannot be confined into few hands as in the case of partnership.

Chances of Increasing Funds

A joint-stock company has wide power by law to raise its effective funds and capital by (a) sales of its debentures. (b) sale of its shares. (c) issue of secured and unsecured bonds ( In advanced counters) (d) Contracting loans on a mortgage of its assets.

Job Opportunity

Joint stock company provides job opportunities to millions of people working there in various industrial units.

Flexibility

As management of the company is conducted by few persons known as the board of directors, they are in a position to bring new changes in the business. Capital sources and human abilities can be adjusted to the new situation. If the director is found indifferent in this respect he may be removed from his office.

Economies

It can enjoy the benefits and economy of large-scale production, management, and distribution. By introducing better methods of production they try to save or reduce unnecessary expenditures.

Growth of Economic activities

Joint stock companies increase the economic activities in the country. These provide the major source of revenue for the government. Industrial units produce the goods at a large scale and thus provide the necessitates of life at a low price. so the healthy growth of joint stock companies may bring positive results in the economic structure of the country.

Loans at Company Name

The company can receive loans in its own name which are payable by the company itself. But in the partnership, the loans are obtained by the partners by their own names which creates various problems for them.

Roles

Its activities are controlled by many central or provincial departments. They are numerous rules which must have to be carried into effect by the company. It has to audit its account and submit the various reports to Registrar's office. It thus cannot operate freely without any interference.

Numbers of Members

There are large numbers of members in the joint stock company. In the case of a public company, a minimum number of members is seven and there is no restriction for the maximum number of members. In the case of a private company, the minimum number of members is two, and the maximum is fifty.

Agreements or Contracts

As a joint-stock company enjoys a separates existence it may enter into trade agreements in its own name.

Change the Nature of Business

In the partnership, the nature of the business may easily be changed with mutual consent from partners. But object clause of the Memorandum of Association which also describes the nature of the business may not be Changed except the sanction of the court.

Why Joint Stock Company is Bad? 15+ Disadvantages

The Demerits

Why they are Bad?

• Is formation Easy?

• Does it have high Expenses?

• Who has control?

• What is personal Interest in?

• Does it have troubles?

• What about Responsibility?

• Is it monopolistic?

• Why there are conflicts?

• What is the social role of it?

• Is it corruption free?

• Who holds the income?

• What is business privacy Concerns?

Disadvantages

• Not really

• Yes, it has more expenses

• Board of Directors

• Generally, it faces shortages

• Yes it may

• Everyone is, but no one

• Yes, after growth

• Because of personal Interest

• It has many drawbacks

• It depends

• It is in few hands only

• There are no business secrets

Complicated Formation

The process of the formation of all types is very complicated. It requires a long time and formalities. Like, Director's appointment, There are many legal documents that must be prepared and submitted to the registrar's office before its formation.

Operational Expenses

A joint stock company is a costly organization. Certain fees and other charges during the operation are paid to the government. Many persons are engaged in various departments and heavy salaries are paid to them. So its financial source is utilized in unproductive sectors.

Concentration of Control

The management of the joint-stock company is concentrated into a few hands known as the board of directors. The shareholders who are the actual owners are not entitled to participate in the affairs of the company. So, they cannot know the internal activities of the directors who take undue benefits from their ignorance.

Limited Personal Interest

Its ownership belongs to thousands of persons who do not know each other. Secondly, the business activities are conducted by paid persons who do not take an interest to create a direct relationship with the public. SO, a business may suffer a loss due to the absence of personal relationships.

Promotion of Speculation

The price of the shares fluctuates at the stock exchange due to various factors. This promotes careless speculation in the country which results in trouble for the public.

Lack of Responsibility

Directors generally employ their friends and relatives on key jobs. But these persons are incompetent and inexperienced to conduct and follow the affairs of the business. So they cannot perform their professional duties with great responsibility.

Growth of Monopoly

The growth of joint-stock companies leads to a monopoly which is always against the public interest. It trees to have monopolistic control over the market. So this becomes the cause of the sufferings of the peoples and dissolution of the small firm.

Conflict of Interest

There are various groups in the joint stock company who have different voting rights, power, and share in the dividend. This disparity creates a conflict of interest between shareholders and management groups and among different types of shareholders which results in misunderstanding friction and exploitation of shareholders.

An Absence of Mutual Spirit

It is highly essential for the successful operation of the company that there must be a spirit of mutual help among the members. But this quality cannot be found in the company due to the transferability of shares.

Social Drawbacks

The following are the drawbacks of the growth of joint-stock company:

- Just the rate of wages is not paid to workers.

- Working conditions are not improved.

- Fringe benefits are not provided.

- Human prestige is injured.

- Devices of manipulation have been developed.

- An unhealthy atmosphere within the industry has affected the health of employees.

So the foregoing defects have created great hatred and discrimination between the employers and employees.

Corruption and Fraud

Some shrewd promoters present a very bright picture in the prospectus to attract capital from the public. Thus they deceive innocent investors for the accomplishment of their selfish ends. Moreover, big industrialists create corruption in the political life of the country.

Concentration of Wealth

After the introduction of the joint stock company, the combination among the various business units has been taking place to a great extent which causes the concentration of wealth into few hands. It has split up the society into two groups i.e. rich and poor. The rich have become richer and the poor have become poor.

Leakage of Secrecy

As there is compulsion by law for a public company to publish its accounts and submit various reports to the registrar, the secrecy cannot be maintained forever. Employees may leak out the secrecy of trade agreements, techniques or production, formula, and other necessary matters.

Bogus Report

Directors know the internal affairs of the company, but they do not present a true picture before the shareholders in their respective meetings. So interested parties may not know the actual performance of their business.

Lack of Freedom

There is much interference during the operation of the joint-stock company from various government authorities. There is also a compulsion by law to submit various reports to the registrar's office. So this organization cannot perform its function freely.

Methods for Directors Appointment

In joint stock company, shareholders are owners of the company too. Each share holder's certificate is its ownership paper. This paper can be sold and bought in the market without disturbing all processes.

Selection by Promoters

The first directors of the company are selected by promoters. Their names are generally laid down in the articles of association. But their appointment cannot be valid unless they submit the following two declarations to the Registrar's offices.

- Written consent to act as directors.

- An agreement in writing to take and pay for his qualification share

The foregoing provision does not apply to a private company.

Appointed by the Subscribers

If the articles are silent to describe the first directors of the company, the subscriber to the memorandum is to be deemed the first directors of the company and subsequent directors are to be elected by shareholders in the general meeting.

Elected by Members

The first directors of the company have to retire on the occasion of the first annual general meeting, so the necessary number of directors will be elected by members, in this meeting. Thereafter all such directors shall retire on the expiry of the term laid down section 180 in companies ordinance 1984.

Nomination by the Directors

Natural Appointment

A casual vacancy is caused by death disqualification or the resignation of directors. It may generally be filled up by the board of directors without the prior consent of the shareholders. Such directors will hold office for the remainder of the term of the director in whose place he is appointed under section 180 in companies Ordinance 1984.

Special Appointment

In addition to the directors elected or deemed to have been elected by shareholders a company may have directors or other special interests by virtue of contractual arrangements under section 182 in companies Ordinance 1984.

NUMBER OF DIRECTORS

In case of Public Company

There must be at least seven directors for the management of the company under section 174 of the Company Ordinance 1984. A maximum number of directors are appointed according to the provision of the Articles of Association. Under Section 177 all directors shall be liable to retire on the expiry of the term laid down in section 180.

In case of Private Company

Its shareholders may elect at least two directors and a maximum number of directors will be described by the Articles of Association. The provision of the retirement of directors does not apply to a private company.

Role or Position of Directors

The directors are representative of the shareholders. He is one of those persons who is authorized to conduct the management of the company. The directors are collectively known as the "Board of Directors." They frame policies and take decisions to realize the objects of the company.

Directors have two positions in the Joint Stock Company

As an Agent

Directors are considered special agents of the company and not ordinary agents. The contract made by them will bind the company so long as they act within the scope of their authority. So they are not personally responsible for the contracts they made on behalf of the company. As agents, they have the authority to act in all matters but their powers are limited by the Articles of Association.

As Trustee

- Directors are trustees for the company to some extent.

- They are of the powers placed in their hand to exercise them for the company's benefits.

- They are empowered to make calls, to allot shares, to issue and forfeit shares.

- They are trustees of the company but not for individual shareholders or any third person.

The Circumstances causes Winding Up

Expiry of Fixed Period

Where the period is fixed for the duration of the company by the Articles, it. maybe winding up on the expiry of the period. But the company has to pass an ordinary resolution in general meetings to wind up.

Happening of Event

A company may be wound up on the happening of the event on which (under the Articles) the company is to be dissolved.

Special Resolution

A company may be wound up voluntarily if the company passes a special resolution for this purpose.

Heavy Liabilities

A company may be wound up if the company passes an extraordinary resolution that it cannot continue its business due to its heavy liabilities.

The Ways to Dissolve Company

Statutory Report or Meeting: Procedure in Member's Voluntary Winding Up

Where default is made in submitting the statutory report to the registrar's office or in holding the statutory meeting within the prescribed time or any two consecutive annual general meetings under section 305 (b) in company ordinance 1984.

Statutory Declaration

The majority of directors make a statutory declaration of solvency for submission to the registrar intimating him that have made a full inquiry into the company's affairs, they are of the opinion that the company will be able to pay its debts in full within three years from the commencement f the winding-up,

Special / Ordinary Resolution

After the declaration of solvency has been submitted to the registrar, the company in general meeting passes the ordinary or special resolution as the case may be for the winding up of the company.

Appointment of Liquidator

The company in general meeting appoints a liquidator to wind up the company's affairs and distribute its assets. The remuneration of the liquidator may be fixed in this meeting. On the appointment of a liquidator, all the powers of directors and other officers end except so far as the company in its general meeting or the liquidator himself sanctions their continuance. Within ten days after the appointment of a liquidator, the notice regarding the appointment must be sent to the registrar.

Final Process of Winding Up

If the winding up continues for more than one year, the liquidator has to call a general meeting of the company at the end of each year. When the company's affairs are fully wound up, he has to call the final meeting of the shareholders. At this meeting, the liquidator must submit a final account of the company's affairs to the members. Within one week after the final meeting, the liquidator must file with the registrar a copy of the accounts and a return of the holding of the meeting. At the end of three months from the date of registration of return, the company is dissolved and its name is struck off the Register of Joint Stock Companies.

Inability to Pay Its Debts:

Creditors Voluntary Winding Up

Where the company is unable to pay its debts in the following situation.

If a creditor whose debt exceeds $50,000 or one percent of its paid-up capital whichever is less under section 306

(a) Has served notice requiring payment and is not paid within 30 days.

If execution in favor of creditor remains unsatisfied or

If the court is fully satisfied that the company is quite unable to pay its debts.

The procedure for a creditor's voluntary winding up is as follows:

Solvency Declaration

Statutory declaration regarding the solvency of the company is not necessary in case of the creditor's voluntary winding up.

General Meeting

A general meeting of the company will be called for the purpose of passing the extraordinary resolution. This resolution is required for the winding up of the company because it cannot continue its business because of its liabilities.

Creditor's Meeting

The company must call a meeting of the creditors on the same day or on the following day after the general meeting of the company. A notice must be sent in writing to each creditor for this purpose.

Statement of Company's Position

The directors of the company must lay before the creditors a full statement of the company's position, a list of creditors, and their estimated claims. A director of the company, appointed by other directors must preside at the creditor's meeting.

Intimation to Registrar

The information regarding the notice of resolution passed must be sent to the registrar within ten days from the date of the creditor's meeting.

Appointment of Liquidator

The creditors and the company at their respective meeting may nominate a person to act as liquidator. If different persons are nominated by creditors and companies respectively, the opinion of the creditors shall hold good.

Committee of Inspection

The creditors and the members at their respective meetings may appoint a committee of inspection consisting of five persons in each committee.

Liquidator's Powers and Duties

The liquidator may exercise his power for the winding up of the company with the sanction of the committee of inspection or in the absence of such committee, with the creditors.

Liquidator's Remuneration

The liquidator's remuneration is fixed by the committee of inspection or, if there is no such committee, by the creditors

After the Expiry of One Year

If winding up continues for more than one year, the liquidator must. call the meeting of .creditors and members at the end of each year. He must lay before the meeting an account of his acts for the winding up during the preceding year.

At the End of Winding Up

On completion of the winding up, the liquidators have to cal final general meeting of the members and a meeting of creditors. The notice for these meetings must publish in the gazette and newspapers at least ten days before the meeting.

The liquidator has to lay his reports regarding the accounts and assets of the company before the meeting. Within one week after the date of the meeting, the liquidator must submit to Registrar a copy of his accounts and a return of the holding of such meeting.

Dissolution of the Company

At the end of three months from the date of registration return, the company is dissolved and it ceases its legal entity.

Winding up of a Joint Stock Company Under Supervision of Court

When the court is of the opinion that it is just and equitable that the company should be wound up due to its mismanagement, dead-lock, fraudulent, or any other reasonable grounds.

Resolution

At first, the company has to pass special or extraordinary resolutions to wind up voluntarily.

Petition for Subject to Supervision

When there are frauds or irregularities in the voluntary winding up, the petition may be presented by one or more of the competent parties for winding up under the supervision of the court.

Supervision Order

If it thinks fit, the court may order that the voluntary winding up shall continue but subject to the supervision of the court and on such terms and conditions as the court thinks just.

Power of the Court

The court has the power to appoint an additional liquidator to remove any liquidator. But generally, the liquidator appointed by the company for the voluntary winding up continues in office subject to his giving of security.

Dissolution of the Company

When the supervision order is made, the liquidator may exercise all his powers in a voluntary winding up. On completion of the winding-up, the court will make an order that the company is dissolved.

Special Resolution

A Joint stock company may be wound up by the court if a special resolution is passed for this purpose.

Failure to Commence Business

When the company does not commence business within a year from its incorporation or suspends business for a year.

Reduction in Number of Members

Where the number of members of a public company is reduced below seven or in case of private company below two.

Lisa is a passionate travelers. She spends 3 months every year visiting different places worldwide. She has visited almost every famous place in the world. She herself is an affiliate blogger

Private Limited Company Definition Business Studies

Source: https://businessfinancearticles.org/joint-stock-company

0 Response to "Private Limited Company Definition Business Studies"

Enregistrer un commentaire